trust capital gains tax rate 2022

However long term capital gain generated by a trust still. The tax may not feel.

Generation Skipping Trust Gst What It Is And How It Works

Capital gains on the disposal of assets are included in taxable income.

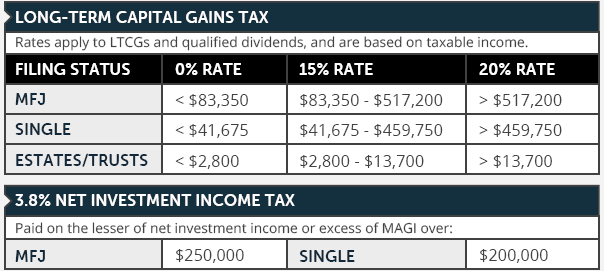

. This means youll pay 30 in Capital Gains. The tax rate for capital gains is as low as 0 percent and as high as 37 percent based on your income and whether the asset was a short-term or long-term investment. Tax Season 2022 - Trust 6 days ago The tax rate for capital gains is as low as 0 percent and as high as 37 percent based on your income and.

Events that trigger a disposal include a sale donation exchange loss death and emigration. 0 2800 15. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act.

The 2022 Capital Gains Tax Rate Thresholds Are Out 1 week ago Nov 10 2021 Those tax rates for long-term capital gains are typically much lower than the ordinary tax rates youd otherwise. For tax year 2020 the 20 rate. 2022 Capital Gains Tax.

2801 13700 20. Show more View Detail 2021-2022 Capital Gains Tax Rates. Complete a Capital gains tax schedule 2022 CGT schedule if you.

10 of 2750 all earnings between 0 2750 275. 1 week ago 2022 Long-Term Capital Gains Trust Tax Rates 0. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended.

Trust capital gains tax rate 2022 - Julio Lister 6 days ago Oct 09 2022 Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. The trustees may apply settled property for the benefit of persons other than the disabled person up to an annual limit of the lower of 3000 or 3 of the maximum value of.

0 2800 15. If their long-term capital gains tax would be 15 and their current marginal tax rate is 28 what are the total tax. For trusts in 2022 there are three long-term capital gains brackets.

What is the long term capital gains tax rate for trusts in 2020. Capital gains tax on second home. 2801 13700 20.

Maximum effective rate of tax. Individuals and special trusts 18. 3 days ago Sep 20 2022 So for example if a trust earns 10000 in income during 2022 it would pay the following taxes.

Are a company trust attribution managed investment trust AMIT or superannuation fund with total capital gains. 20 for trustees or for personal representatives of someone who. 1 week ago Sep 20 2022 So for example if a trust earns 10000 in income during 2022 it would pay the following taxes.

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. The maximum tax rate for long-term capital gains and qualified dividends is 20. 2801 13700 20.

It continues to be. 10 of 2750 all earnings between 0 2750 275. 2022 Long-Term Capital Gains Trust Tax Rates 0.

3 days ago Jun 30 2022 Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. Capital Gains Tax on Inherited Property. 0 2800 15.

The following are some of the specific exclusions. R2 million gain or.

Build A Tax Efficient Taxable Account As A Physician Wealthkeel

The Tax Impact Of The Long Term Capital Gains Bump Zone

9 Ways To Reduce Your Taxable Income Fidelity Charitable

How Are Capital Gains Taxed Tax Policy Center

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Tax Rates Heemer Klein Company Pllc

What You Need To Know About Capital Gains Tax

Deferred Sales Trust 101 A Complete Guide 1031gateway

Capital Gains Tax Real Estate Home Sales Rocket Mortgage

2022 Capital Gains Tax Rates Federal And State The Motley Fool

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)